Risks Make AI Workplace Policies a Requirement

Artificial intelligence (AI) is fast becoming an integral element in the operation of virtually every business and organization. Read More ›

Artificial intelligence (AI) is fast becoming an integral element in the operation of virtually every business and organization. Read More ›

Categories: Artificial Intelligence (AI), Cybersecurity, Digital Assets, Employment, Intellectual Property, Privacy, Technology

Legal Insights Into Businesses Using AI

The AI Revolution is here! Startups across our region are using AI tools in innovative new ways. But could there be legal pitfalls you haven’t considered? Read More ›

Categories: Copyright, Cybersecurity, Did you Know?, Intellectual Property, Liability, Technology

Corporate Transparency Act: What You Need to Know Before 2024

Introduction and Scope of New Rule

Introduction and Scope of New Rule

With a stated goal of countering money laundering, the financing of terrorism and other illicit activities (including those of Russian oligarchs currently under U.S. sanctions), Congress passed the Corporate Transparency Act (CTA) in January 2021 as part of the National Defense Authorization Act. In 2022, the Department of Treasury’s Financial Crimes Enforcement Network (FinCEN) began to publish rules in its efforts to begin enforcement of the CTA likely beginning on January 1, 2024. Read More ›

Categories: Alerts and Updates, Did you Know?, Employment, Legislative Updates, News

Federal Trade Commission Issues Sweeping Proposed Rule to Prohibit Noncompete Agreements

On January 5, 2023, the U.S. Federal Trade Commission (FTC) issued a proposed new regulation that would broadly prohibit employers from using or enforcing noncompete agreements with employees, former employees, contractors, or other workers. Read More ›

On January 5, 2023, the U.S. Federal Trade Commission (FTC) issued a proposed new regulation that would broadly prohibit employers from using or enforcing noncompete agreements with employees, former employees, contractors, or other workers. Read More ›

Categories: Alerts and Updates, Did you Know?, Employment, Labor Relations, News

Cybersecurity Month Serves as Reminder to Take Proactive Steps

Whether you are the CEO of a big corporation working in the office six days a week or an analyst working remotely from home entering data, everyone is at risk of a cyber-attack. Despite the fact that all organizations, regardless of size, are at risk, few have preventative measures in place, or have even planned for how they would respond in the event of an attack. Read More ›

Whether you are the CEO of a big corporation working in the office six days a week or an analyst working remotely from home entering data, everyone is at risk of a cyber-attack. Despite the fact that all organizations, regardless of size, are at risk, few have preventative measures in place, or have even planned for how they would respond in the event of an attack. Read More ›

Categories: Criminal, Cybersecurity, Technology

Process and Requirements of Women-Owned Small Business Certification

The federal government, states, and some cities set aside a percentage of funding to help women-owned businesses. In fact, in 2021, the federal government set aside 5% of its annual spending for businesses that obtained a Small Business Association (“SBA”) Women-Owned Certification (WOSB). Read More ›

The federal government, states, and some cities set aside a percentage of funding to help women-owned businesses. In fact, in 2021, the federal government set aside 5% of its annual spending for businesses that obtained a Small Business Association (“SBA”) Women-Owned Certification (WOSB). Read More ›

Categories: Compliance, Startup

Executive Compensation and Negotiation Essentials for Women Leaders

Staying competitive, especially in a male-dominated profession, can seem like a daunting task for many women.

Staying competitive, especially in a male-dominated profession, can seem like a daunting task for many women.

In your discussions with your current or future employer, it is crucial to know when to approach and ask for extra benefits. These benefits go beyond standard taxable compensation. The timing and type of benefits are very fact-specific and will depend on your role and company: do your research. Understanding a company's goals and business concerns as they relate to long-term retention allows you to shape your proposition. It is also helpful when it comes to understanding your employment and compensation goals, offering a mutual benefit to both yourself and your employer. Read More ›

Categories: Employee Benefits

Key Considerations on How to Sell Your Business

No matter the reason, when selling a business, it is important that the business owner and advisors understand the broader reasons for the sale to ensure that the deal is structured to achieve the seller's goals. Read More ›

Categories: Compliance, Mergers & Acquisitions, Sales/Disputes, Tax, Tax Disputes

Michigan Launches “Afflicted Business” Grant Program

Nearly two years after the start of the COVID-19 pandemic, the state of Michigan is continuing to design new programs to help support Michigan businesses that were negatively impacted by the pandemic and resulting economic shutdowns. Beginning March 1, 2022, Michigan will distribute up to $409 million under the new Afflicted Business Relief (ABR) grant program. Eligible businesses can apply beginning March 1, 2022 through March 31, 2022. Grants are not first-come, first-serve, but instead may be prorated depending on the number of eligible businesses that apply. Read More ›

Nearly two years after the start of the COVID-19 pandemic, the state of Michigan is continuing to design new programs to help support Michigan businesses that were negatively impacted by the pandemic and resulting economic shutdowns. Beginning March 1, 2022, Michigan will distribute up to $409 million under the new Afflicted Business Relief (ABR) grant program. Eligible businesses can apply beginning March 1, 2022 through March 31, 2022. Grants are not first-come, first-serve, but instead may be prorated depending on the number of eligible businesses that apply. Read More ›

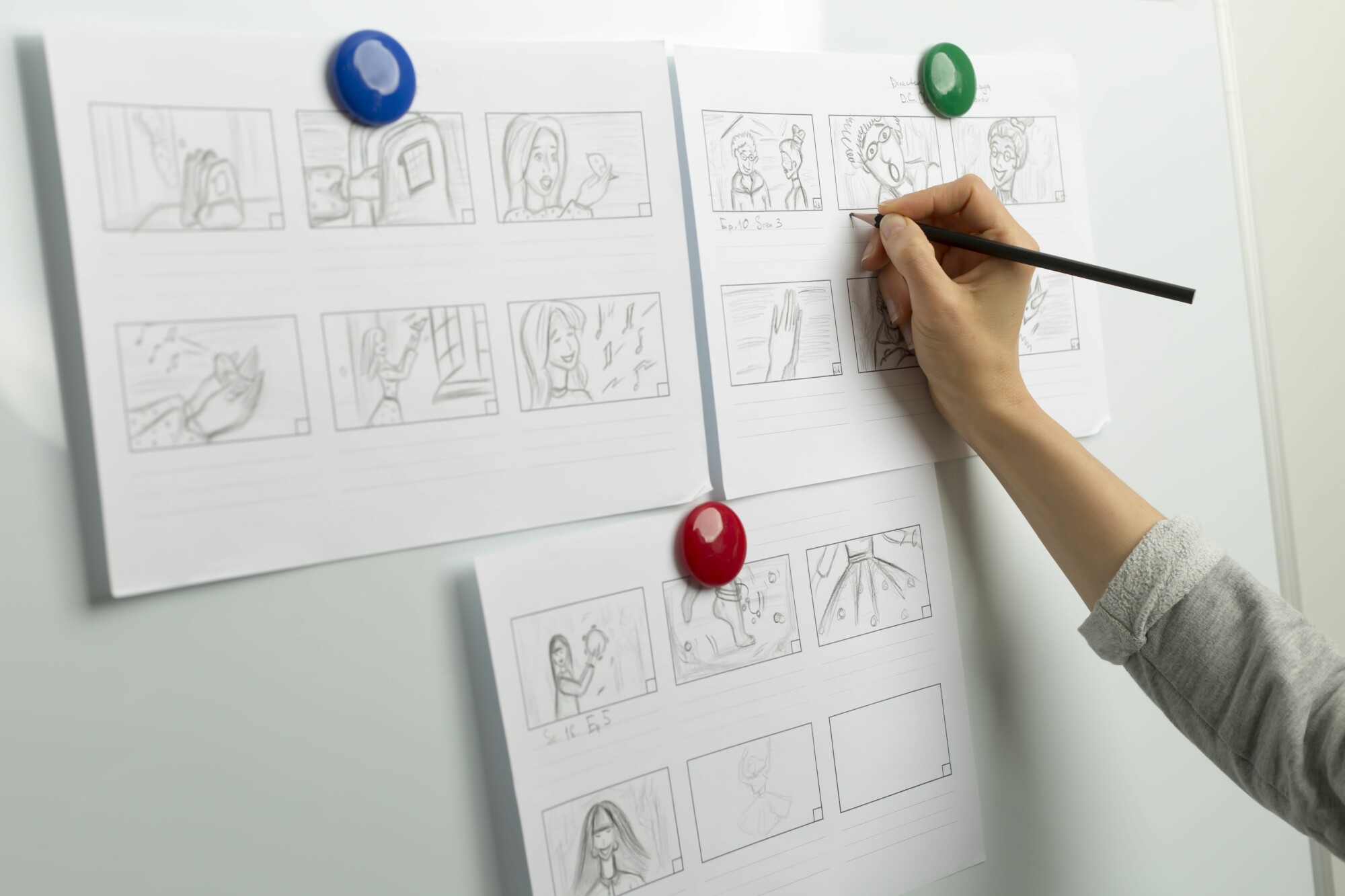

Inspiration Arises From Disaster: A Film Project Over a Decade in the Making

The ongoing pandemic has wreaked havoc on the film industry, with most theaters shut down in 2020. Even now, many blockbuster films have gone straight to streaming services.

The ongoing pandemic has wreaked havoc on the film industry, with most theaters shut down in 2020. Even now, many blockbuster films have gone straight to streaming services.

One local filmmaker's vision began nearly a decade before the COVID pandemic. It all started with another tragic disaster, but from that disaster, a story unfolded and inspired a film project. Read More ›

Categories: Crowdfunding, Distribution, News

Amanda J. Dernovshek

T: 517.371.8259

F: 517.371.8200

adernovshek@fosterswift.com

Taylor A. Gast

T: 517.371.8238

F: 517.371.8200

tgast@fosterswift.com

Lindsey M. Mead

T: 517.371.8326

F: 517.371.8200

lmead@fosterswift.com

Categories

- Lawsuit

- Crowdfunding

- Patents

- Legislative Updates

- Sales Tax

- Domain Name Registration

- Licensing

- Tax

- Estate Planning

- Cybersecurity

- Hospitals

- Employment

- IT Contracts

- Artificial Intelligence (AI)

- Mergers & Acquisitions

- Social Media

- Did you Know?

- HIPAA

- Liability

- Fraud & Abuse

- Tax Disputes

- Entity Selection, Organization & Planning

- Cloud Computing

- Compliance

- Privacy

- Distribution

- Copyright

- Elder Law

- Retirement

- Hospice

- News

- Criminal

- Department of Labor

- Defamation

- Contracts

- Entity Planning

- Financing

- Venture Capital/Funding

- Startup

- Electronic Health Records

- Digital Assets

- Technology

- Corporate Transparency Act (CTA)

- Labor Relations

- Trademarks

- Billing/Payment

- Regulations

- Personal Publicity Rights

- Intellectual Property

- Employee Benefits

- E-Commerce

- Sales/Disputes

- Inspirational

- Alerts and Updates

- Insurance

- Trade Secrets

- Chapter 11

- National Labor Relations Board

Share

Share